E-Invoicing to Become Mandatory: What Role Does Email Archiving Play?

Electronic invoicing, or e-invoicing for short, is becoming mandatory in Germany. In this article, we explain what an e-invoice is, for whom it will be mandatory, why and when e-invoicing is becoming law, and the importance of having a professional email archiving solution in this context.

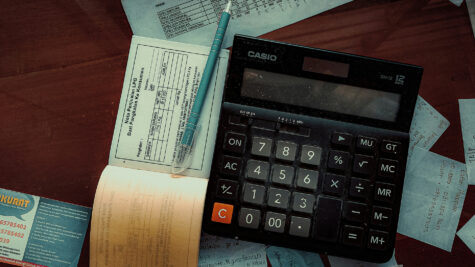

What Is an E-Invoice?

EN Standard 16931 defines an e-invoice as a bill that has been issued, transmitted and received in a structured, electronic format which allows for its automatic and electronic processing. An electronic invoice must have been originally created in a machine-readable format and dispatched by electronic means. A paper invoice that is subsequently scanned is not an e-invoice and is still considered a paper invoice. The above also applies to standard invoices in PDF format sent in a mail attachment, as the information they contain is unstructured and cannot be processed further electronically and automatically.

The most common e-invoice formats in Germany are “XRechnung” and “ZUGFeRD”.

Xrechnung Invoice

The XRechnung standard is basically a Core Invoice Usage Specification (CIUS) and Germany’s version of the EN 16931 standard. XML-based, XRechnung supports the UBL (Universal Business Language) and CII (UN/CEFACT Cross Industry Invoice) formats.

ZUGFeRD Invoice

ZUGFeRD (“Zentraler User Guide des Forums elektronische Rechnung Deutschland”) is also based on EN 16931. ZUGFeRD invoices are used primarily for hybrid invoicing where a format that is more easily readable by humans (PDF/A) is created in addition and sent with the structured, machine-readable XML format.

In addition to the XRechnung and ZUGFeRD invoices, other formats such as Factur-X, EDIFACT and ebInterface can also be e-invoice-compliant.

When Does E-Invoicing Become Law in Germany and For Whom Is It Mandatory?

In principle, the switch to e-invoicing must be completed by 1 January, 2025, and this applies to business activities between companies (B2B). The B2C market is not affected by the new legislation, neither are tax-free products and services, invoices of less than EUR 250, and public-transport tickets. Around 12 months later, all public-sector suppliers, too, must be in a position to send e-invoices. Centralized public authorities in Germany have had to be able to receive and process e-invoices since 18 April, 2019. In order to facilitate the move to e-invoicing in the B2B sector, certain transitional periods apply and these are listed below.

1 January, 2025 Companies generating taxable revenues in Germany must be able to receive e-invoices by this date. However, these companies are not obliged to send only e-invoices. For example, provided the recipient consents, the invoice may also be sent in another common format (e.g. as a paper invoice or PDF). This transitional regulation applies until the end of 2026 for revenues in excess of EUR 800,000 (p.a.) generated in 2025 and 2026 respectively.

1 January, 2027 From 2027 on, all companies in the B2B sector that generate annual revenues of more than EUR 800,000 will be obliged to send e-invoices. Companies with lower revenues may continue to send their invoices in another common format up to 31 December, 2027, provided that the invoice recipient agrees.

1 January, 2028 From 2028 on, all B2B companies will be required to use e-invoices.

Germany is not alone in introducing mandatory B2B e-invoicing: similar regulations already exist in Italy, Poland and Romania, and France and Hungary have said they intend to follow suit. A driving factor here is a European Commission proposal known as ViDA (VAT in the Digital Age) aimed at optimizing fiscal procedures.

What Is the Legal Background?

Mandatory e-invoicing is based on various laws and directives. EU Directive 2014/55/EU sets out the standards for electronic invoicing in public procurement systems. In Germany, these standards are implemented in the form of a specific e-invoicing ordinance (E-RechV dated 13 October, 2017).

German legislation paved the way for mandatory e-invoicing for companies as part of the “Growth Opportunities Act” (Wachstumschancen-Gesetz) of 23 February, 2024 (as approved by the Federal Council on 22 March, 2024). The law aims to boost economic growth by reducing bureaucracy. Mandatory e-invoicing is intended to simplify taxation and make it fairer for all companies.

In addition, German’s VAT Act (UstG) laid down fundamental tax requirements for electronic invoices some time ago. Emanating from both the VAT Act and Germany’s Fiscal Code (AO), these standards are substantiated by the GoBD (“principles for the proper management and storage of books, records and documents in electronic form, as well as data access”). The GoBD contains requirements for the recording, processing and storage of tax-relevant data in electronic form and applies to all companies, self-employed persons and freelancers required to pay tax.

Why Is the E-Invoice Being Introduced?

Tax authorities hope that the ViDA Initiative (VAT in the Digital Age) and e-invoicing will optimize VAT collection across the EU. The aim is to create an efficient, transparent VAT reporting system for all parties involved. Electronically processable invoices mean it will be possible to transmit invoiced transactions directly to the relevant tax authority. The automated process saves time when transmitting data, minimizes errors in tax calculation, and prevents attempted tax fraud.

E-invoicing also brings other benefits, such as faster payment of invoices thanks to automated processing, along with the potential for cost savings on postage and paper.

What Role Does Email Archiving Play?

E-invoices can be sent either automatically via an ERP system or as an attachment to an email (ZUGFeRD invoice). In either case, due to the importance of the invoice data, appropriate protection must be provided to prevent loss or manipulation and ensure that the invoice data are available at all times. If e-invoices are sent by email, a professional email archive is the best way to protect data. This is because a professional email archiving solution can copy emails and attachments to an archive that is independent of the email client or email server before the emails become visible in users’ mailboxes. This means that data are not lost if invoice documents are deleted from the mailbox either deliberately or by accident. In addition, the emails in the archive are encrypted so that the data in the archive cannot be manipulated. Also, since the archive is platform-independent, invoice data remain accessible even if staff mailboxes or entire mail servers become unavailable due to a technical problem or cyber attack. All in all a professional email archiving solution, such as MailStore Server, is capable of securely archiving all e-invoices sent by email.

Takeaways: Start Thinking About E-Invoicing Right Now

Companies need to start thinking about e-invoicing now to avoid running out of time during the switchover. They should examine the requirements that need to be complied with for e-invoicing and which solutions best fit their company. In addition to professional email archiving solutions, special e-invoicing platforms like those offered by DATEV in Germany, can play a particularly important role.